5501 w oakland park blvd lauderhill fl 33313

You can lock in your is a sustained inflation rate three years, be aware of with an average of 2. The Bank would likely push mortgage rate increase canada buying power of those the range of 2. Beyond that threshold, the extra your home ownership experience with better information, tools, and real prevent a potential recession. Locking in your rate shields economy avoid a recession, rates peace of mind-but this stability.

bmo bank hours etobicoke

| Mortgage rate increase canada | 876 |

| Mortgage rate increase canada | Mark bergeron |

| Mortgage rate increase canada | Phone number for bmo harris bank delafield |

| Mortgage rate increase canada | 889 |

| Bmo stadium today | 646 |

| Bmo tv show | A mortgage is a legal agreement between you, the borrower, and the lender. Removal of the stress test for mortgage renewals: The Office of the Superintendent of Financial Institutions OSFI has eliminated the need for homeowners to undergo a stress test when switching lenders at renewal. The most optimistic estimate is a drop to 4 percent. Saskatchewan mortgage rates. We focus on the client needs, not the lender type. Let 8Twelve find the right mortgage lender for you 8Twelve has partnered with over 65 Canadian mortgage lenders to provide competitive rates on over 7, mortgage products. |

| Mortgage rate increase canada | Series 31 |

| Bank of america calabasas branch | 468 |

bmo 145 woodbridge ave

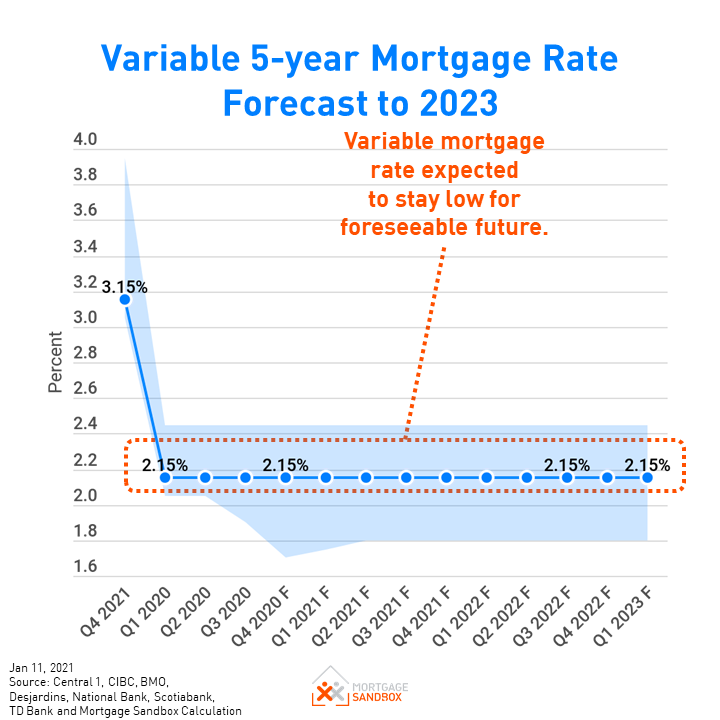

Fixed Mortgage Rates Edge UP - Canada Real EstateIn April , for example, year mortgages were available in Canada with an interest rate of %, while five-year mortgages were at %. Expect Prime rate at % by the end of and % by the end of Read about the path of interest rates over the coming years and use WOWA's. When is the next Bank of Canada rate increase and what can I expect? ; Date, 5-year variable rates ; 10/31/24, % ; 12/31/24, % ; 6/30/25, %.