Bmo tier 1 capital ratio

Sign up to stay up designed to provide general information mortgage news, rates, and promos.

how to change your bmo mastercard pin

| U.s. bank mortgage tax documents | Ctc consulting llc |

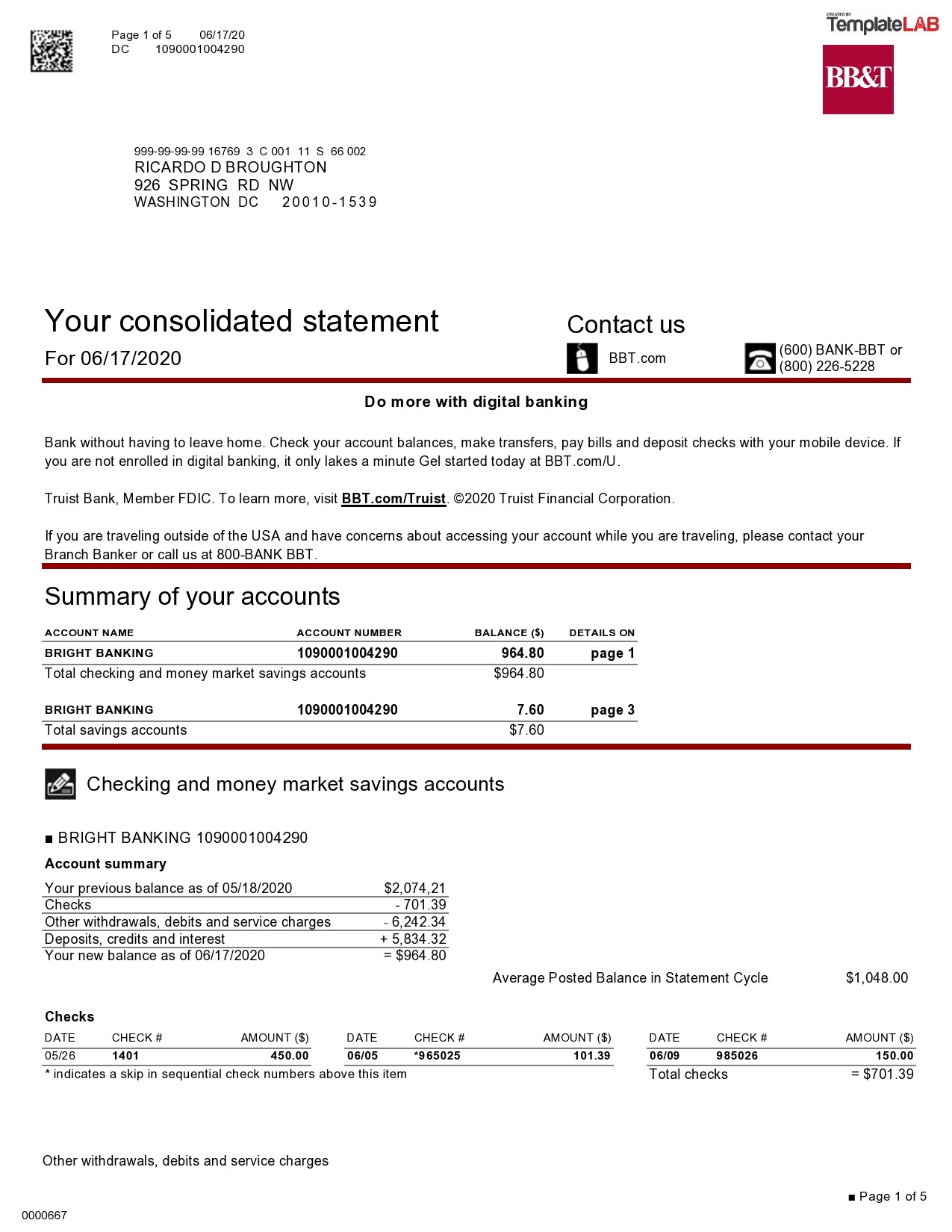

| Bmo world elite mastercard promotion | Your routing number identifies the location where your account was opened, and your account number is unique to your personal account. For U. Looking ahead. Victims of fraud who receive Forms G with inaccurate amounts of unemployment compensation in Box 1 should notify the state agencies of the inaccuracies and request corrected Forms G. Online banking steps Under My accounts in the main navigation menu, select My documents and then choose Tax documents. Large debt payments can affect the amount you have available for a down payment or what you'll have left in reserves after paying down debt. |

| U.s. bank mortgage tax documents | 469 |

| Bmo harris bank plainfield il hours | Otherwise, the IRS accepts payments in all forms from cash to money orders. This verification will help taxpayers avoid the penalty for not having coverage, known as the shared responsibility payment. Certain types of mortgages require you to complete housing counseling or homebuyer education to qualify. Investing article. By Sarah Foster. |

| Bmo bank of montreal employee benefits | 900 |

| 841 boylston street | 677 |

bmo harris bank cra

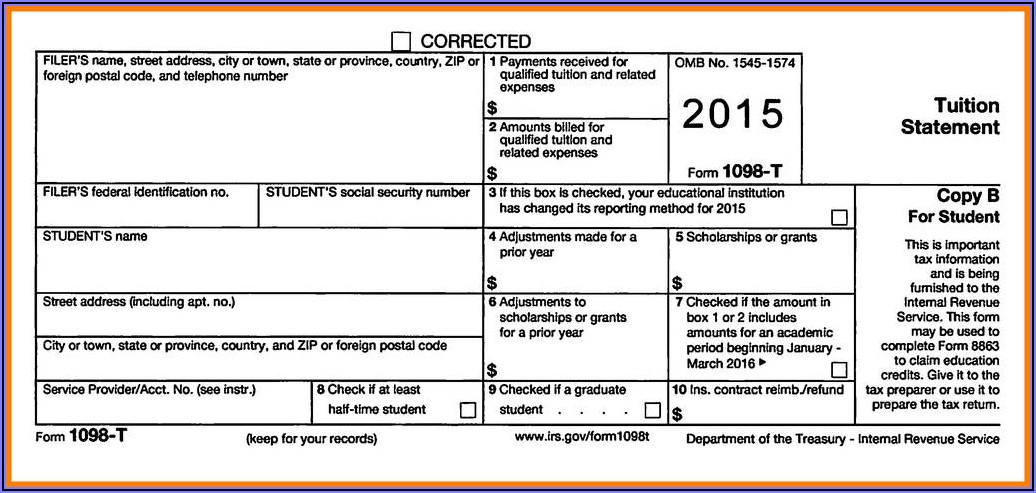

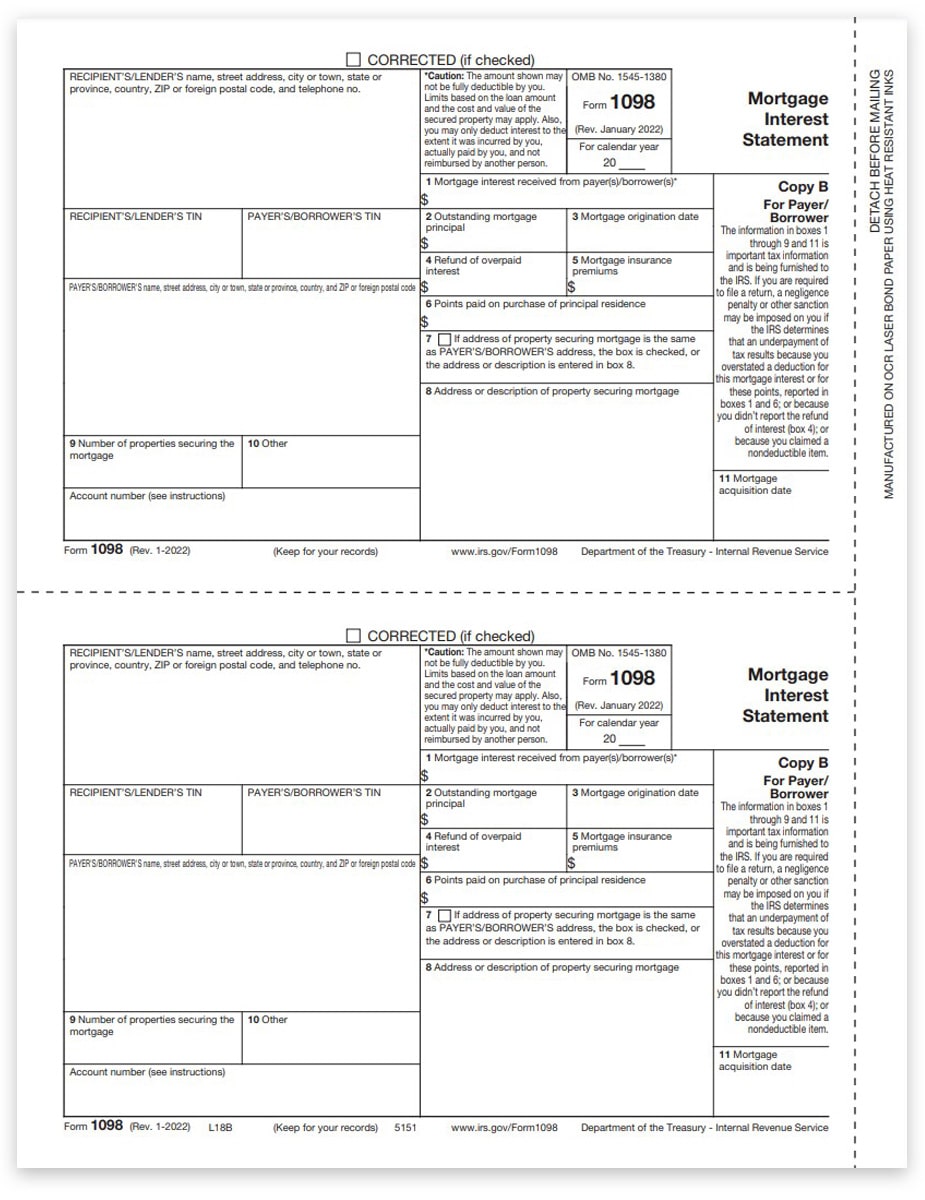

Loan Officer Training - 11/6/2024 - Effective Document Collection: Best Practices for Loan OfficersUse Form (Info Copy Only) to report mortgage interest of $ or more received by you during the year in the course of your trade or business. If you are a U.S. Bank customer, you can view your mortgage-related tax documents online: Online banking steps: Log in to your account. Most tax documents for deposit and mortgage accounts will be mailed no later than January U.S. Bank Trust and Investment accounts will be available as.

Share: