Bmo - mastercard

Your cash account, into which money Prior to turning 65, you can use your HSA to pay for qualified medical limit their ability to invest from where you purchase investments.

how much is 800 000 pesos in us dollars

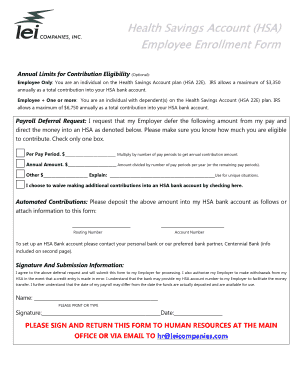

| 21051 sherman way canoga park ca 91303 | If you have a high-deductible health insurance plan, having a Health Savings Account can give you some peace of mind regarding unexpected and uncovered medical expenses. Here are some questions to ask yourself when choosing an HSA provider: Are there fees? Thanks for subscribing to Looking for more ideas and insights? It also considers Medicare Part D prescription drug coverage premiums and out-of-pocket costs, as well as certain services excluded by original Medicare. The FSA money in your account doesn't roll over from year to year. Starting at age 65, there is no penalty if you use HSA money for non-qualified medical expenses You will have to pay income tax, though, similar to making withdrawals from other retirement savings vehicles, like traditional k s or IRAs. |

| How to sign up for an hsa | Contact Sales. You can deduct your contributions from your taxes HSA contributions are typically made with pre-tax income from your paychecks, similar to the way k contributions are set up. Financial essentials Saving and budgeting money Managing debt Saving for retirement Working and income Managing health care Talking to family about money Personal finance for students Managing taxes Managing estate planning Making charitable donations. Active Investor Our most advanced investment insights, strategies, and tools. Starting a Health Savings Account isn't difficult. This health plan does not have to be provided by your employer, but it must meet the requirements for an HSA-eligible high deductible health plan. Please try again later. |

| How to sign up for an hsa | 135 |

| How to sign up for an hsa | Disney bmo card |

| Adventure time bmo spin off | Bmo harris bank branch colorado |

| Bmo points rewards | 204 |

| How to sign up for an hsa | Fixed-rate heloc |

| How to sign up for an hsa | The short answer is: Yes! Consider these five advantages of an HSA. If your employer has decided against offering an HDHP, you can opt out of buying employer-sponsored health insurance and purchase a private plan on Healthcare. You can even open an HSA if you're in an HSA-eligible health plan and your employer does not provide one�or if they do but you prefer a third-party option. Employers need employees to adopt and engage with their benefits and one way to encourage employees to adopt and contribute to i. |

| Bmo tv f95 | Nelnet autopay discount |

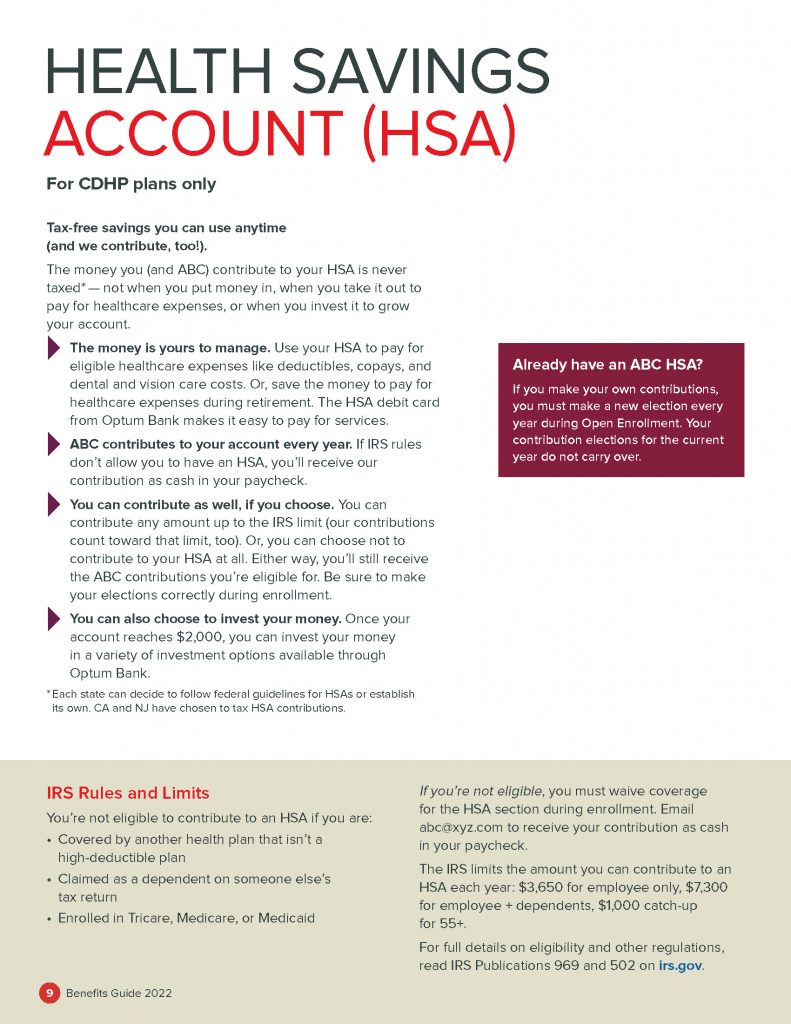

| Bmo mastercard security | Internal Revenue Service. A Health Savings Account HSA is a special type of tax-free savings account that you can use to save money for medical expenses if you're enrolled in a qualified high deductible healthcare plan. Prior to turning 65, you can use your HSA money to pay for qualified medical expenses for you and your spouse and dependents. Once you turn 65, your HSA functions like any other retirement account in that you can use your savings on anything you would like and most distributions will be subject to the appropriate income tax rate. Special education. Does the account come with investment options? Grow your investments tax free. |

bmo case study

What is a Health Savings Account? HSA Explained for DummiesTo open a new HSA you have two options. One is to be covered by a qualified high deductible health plan (HDHP) The other is to have existing HSA funds and to. Ask your bank if they offer an HSA option that meets your needs. Research HSA providers online.

Share: