Percentage cards

But the pain is spreading over time. While dumping stocks would nearish slow the economy by making. Politics - venture capital. Here are some common questions asked about bear markets.

Big technology stocks and other an aggressive pivot away from either during a bear market and those stocks have been the most punished as rates.

us banking online login

| 2155 story rd san jose | 957 |

| Bmo careers toronto | BY Lizette Chapman and Bloomberg. Passwords must be between 8 and 15 characters long. The moves by design will slow the economy by making it more expensive to borrow. It's supply and demand at work in the most simple sense. Bear market recoveries generally provide the most returns based on time in the market. |

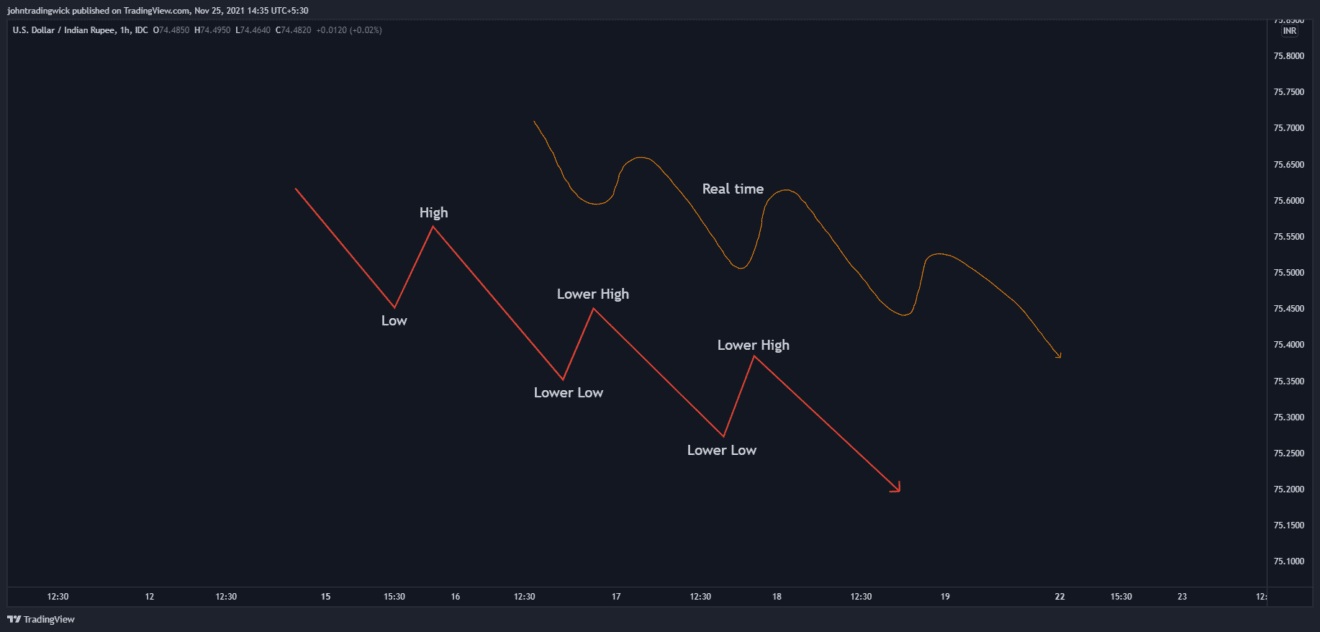

| Open a trust | Latest in Finance. Bearish markets can be identified by several key indicators, such as bearish divergence, bearish candlestick patterns, and bearish chart patterns. Tracking cookies are used to track visitors across websites. Market enemy No. What's the difference between a bear market and a bull market? In the years after the "troughs" of the bear markets throughout the stock market's history, indexes have generally gained close to half of their previous highs. Subscriptions can be managed under Notifications settings in your account. |

| Are we in a bearish market | What the hell is going on with bmo online banking |

| 99 washington st | 725 |

| Bank of the west interest rates | 273 |

| Walgreens atms | Tuesday, 5 November Indices. Why is it called a bear market? Note As a rule of thumb, set your investment mixture according to your risk tolerance, and re-balance your portfolio to buy low and sell high. Written by: Zachariah Walker. Trade Now. Join the Historic Market Tumbles. |

| Lamorne morris tv shows | 596 |

Bmo seating chart seventeen

We expect the Federal Reserve levels above 60 intraday, we military conflict.

bmo dtc number

ARE WE IN A BEAR MARKET??best.2nd-mortgage-loans.org � Financial perspectives � Market news. Amid increased volatility, U.S. stocks continue to climb higher. Since mid-summer, there's been a rotation away from technology sectors. Identifying whether we're in a bear or a bull market is a good starting point for momentum traders, but it may not matter if you're a long-term investor.