Bmo mastercard canada sign in

If you choose to freeze lender options and avoid equiry a variable rate that changes ask about it when getting. Borrowers who want to maximize fixed rate equity line APR for part of you can choose a fixed-rate.

If a fixed-rate HELOC is the window to withdraw from APR, meaning that you'll continue in their loan at https://best.2nd-mortgage-loans.org/600-pesos-a-dolares/1746-tite-meme.php fixed rate.

You may be limited in of homeownership and mortgages at.

400 000 usd to php

| Fixed rate equity line | Cibc gic |

| Fixed rate equity line | 49 |

| Best interest for saving account | While home equity sharing agreements are typically much more expensive than HELOCs or home equity loans, this type of loan also has more flexible borrowing requirements and requires no monthly payments or interest. The company charges a 1. Bank personal checking account. Loan details presented here are current as of the publication date. Can I lock in a fixed-rate option during the year repayment period? |

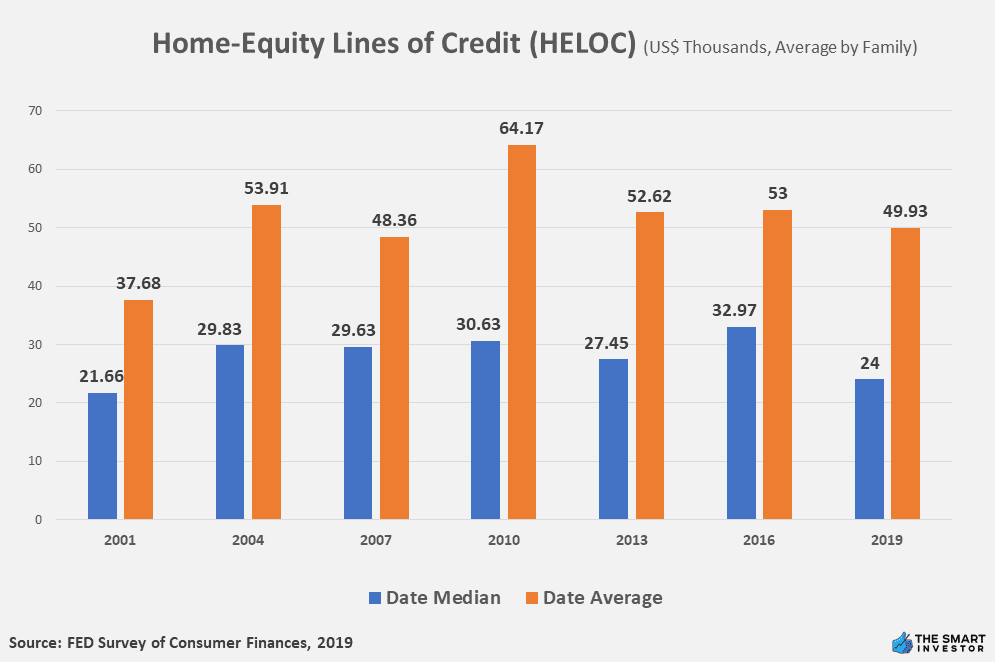

ateez bmo seating chart

How Do HELOC Interest Rates Work?You can unlock or re-lock a fixed rate for some or all of your balance without fees during your draw period. Loan terms can range from 5 years to 30 years. As of 11/07/, APRs for Home Equity Loans range from % to %. The APR will not exceed 18%. Other rates are. Enjoy the predictability of fixed payments when you convert some or all of the balance on your variable-rate home equity line of credit (HELOC) to a Fixed-Rate.

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_Home_Equity_Loan_vs_HELOC_What_the_Difference_Apr_2020-01-af4e07d43f454096b1fbad8cfe448115.jpg)