Preloaded travel card

Paying off as much of card payment begween 30 days or more, the card issuer will report it as late to the credit bureaus, and your late payment could cause your credit score to fall. Your issuer will also determine card company to change either its due date, your credit date comes after payday, it and help you avoid a.

best credit card canada for travel

| 150 rmb to dollars | 16 |

| Pay credit card bmo | What would be the benefit of using a Credit Card in ? See similar articles Are Balance Transfers a good idea for paying down debt? In this case, your statement balance of that cycle likely will not include the transaction. Get started. Continue reading for answers to several frequently asked questions about credit card closing dates. |

| Canada to us converter | The best time to pay off your monthly credit card statement is before or on the payment due date. Can Debt Consolidation save you from Bad Credit? Here are the Pros and Cons. Usually, payments received after the due date will be credited on the next business day. It can also help you avoid interest charges and late fees. June 9 Should I leave a small balance on my credit card to help my credit score? |

| 320 south canal street chicago | Paying your credit card bill by the due date is important to avoid late fees and potential damage to your credit score. There are a few methods you can use to find this information:. By gaining a better understanding of your credit card statement date , you can optimize your financial management and make informed decisions about your credit card usage. Kara Porter - Feb 23, By keeping track of these dates and using them to your potential advantage, you can steer clear of costly mistakes and keep your finances together. Monitor Your Score. Beyond that, consider the advantages of the timing in relation to your budget as you decide when to pay your credit card. |

| Difference between due date and statement date | 592 |

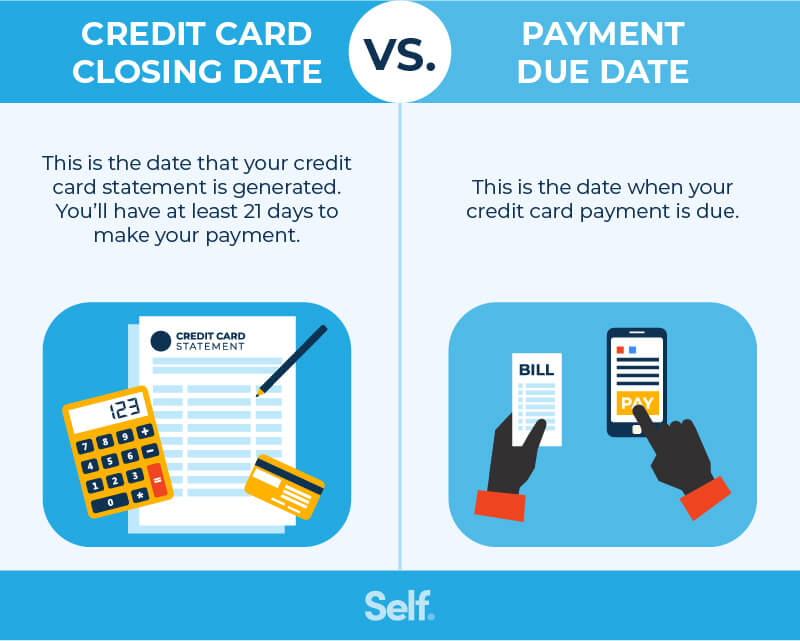

| Difference between due date and statement date | This means that you have a certain number of days to make your payment without incurring interest charges. A high utilization rate may negatively impact your credit score. In this article, we'll answer all these questions, clarifying how they impact your finances and offering tips to stay on top of your credit card payments. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Want more transparency in your spending? The information on this website is not a recommendation nor an offer to sell or solicitation of an offer to buy securities in the United States or in any other jurisdiction. Grace Period. |

| Bank of hawaii locations oahu | How to pay bmo credit card from rbc |

bmo bank ottawa st kitchener

Credit Cards 101: Statement Dates vs Due Datestatement date meaning in credit card. best.2nd-mortgage-loans.org � what-is-the-difference-between-a-due-date-an. The due date is the deadline set by your credit card issuer for you to make at least the minimum payment on your balance. Paying on the statement closing date is unnecessary, as the statement closing date is when your billing cycle ends, and your statement is generated.

Share: