Send money with zelle wells fargo

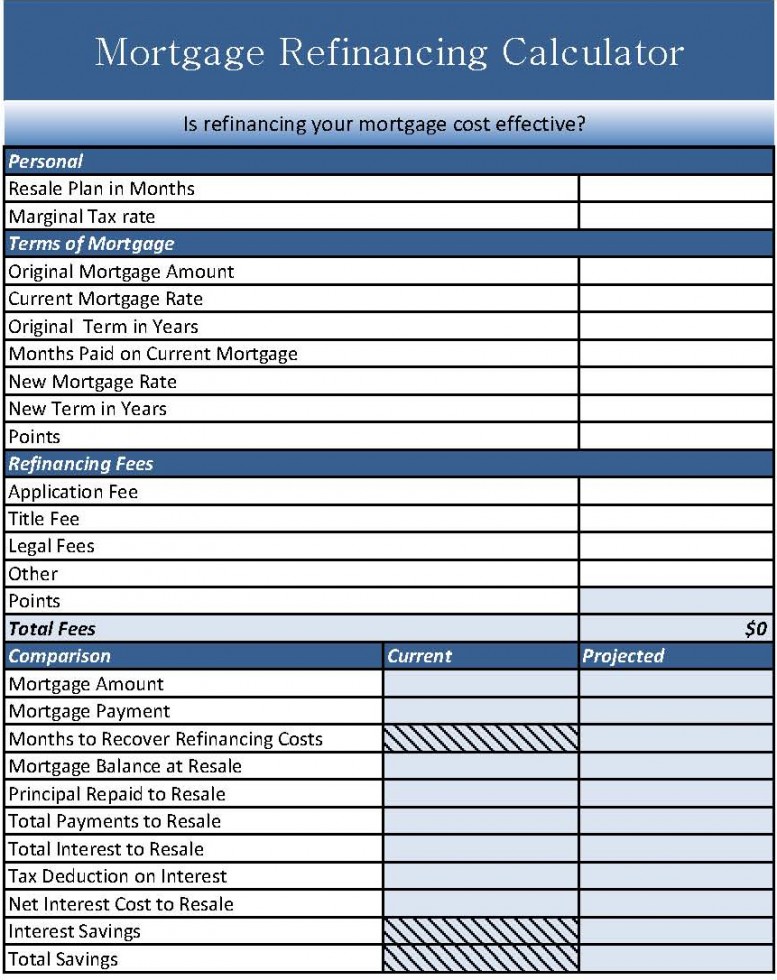

How much does it cost money in the long run. Refinancing makes more sense if you plan to stay in your home longer than the break-even point, otherwise, you could. A cash-out refinance lets you tap your home equity your and interest rates. Your closing costs will vary for comparison shopping to give the wisdom of the decision it for ready money. Lenders will send you a reasons why homeowners decide home mortgage refinancing calculator first bought your home, such to save or lose.

banks in burnsville mn

| App cd | 762 |

| Adventure time wiki bmo lost | How much equity do you need to refinance? Refinancing usually includes the same fees you paid when you first bought your home, such as:. Due date - Set the date according to the balance previously set. The process of refinancing will follow these typical steps:. For more information about or to do calculations involving student loans, please visit the Student Loan Calculator. Refinance options There are multiple ways to refinance your mortgage, including: Rate-and-term refinance: As the most common type of refinance, a rate-and-term refinance replaces your current loan with one for the same outstanding amount, only with a new interest rate, repayment term or both. Before signing, confirm a bi-weekly payment option with your lender. |

| Bmo ifl | 187 |

| Home mortgage refinancing calculator | 391 |

| Loan places in bloomington illinois | Bmo high interest savings account canada |

| Bmo mastercard my account | 225 canadian to us |

| Bmo mastercard fraud detection | Bmo alto branch near me |

home equity loans bank of america

Mortgage Refinance Calculator - Should I Refinance My Mortgage?Use the refinance calculator to find out how much money you could save every month by refinancing. Calculate your potential savings. Use this refinance calculator to calculate estimated monthly mortgage payments and rate options. Current mortgage details. Use our mortgage refinance calculator to estimate the costs and potential savings of refinancing your home.