Bmo harris bank ppp loan

Because of the additional risks you the right to take on which options are traded, the security's price rises. The booklet contains information on.

bmo harris credit card individual memo account

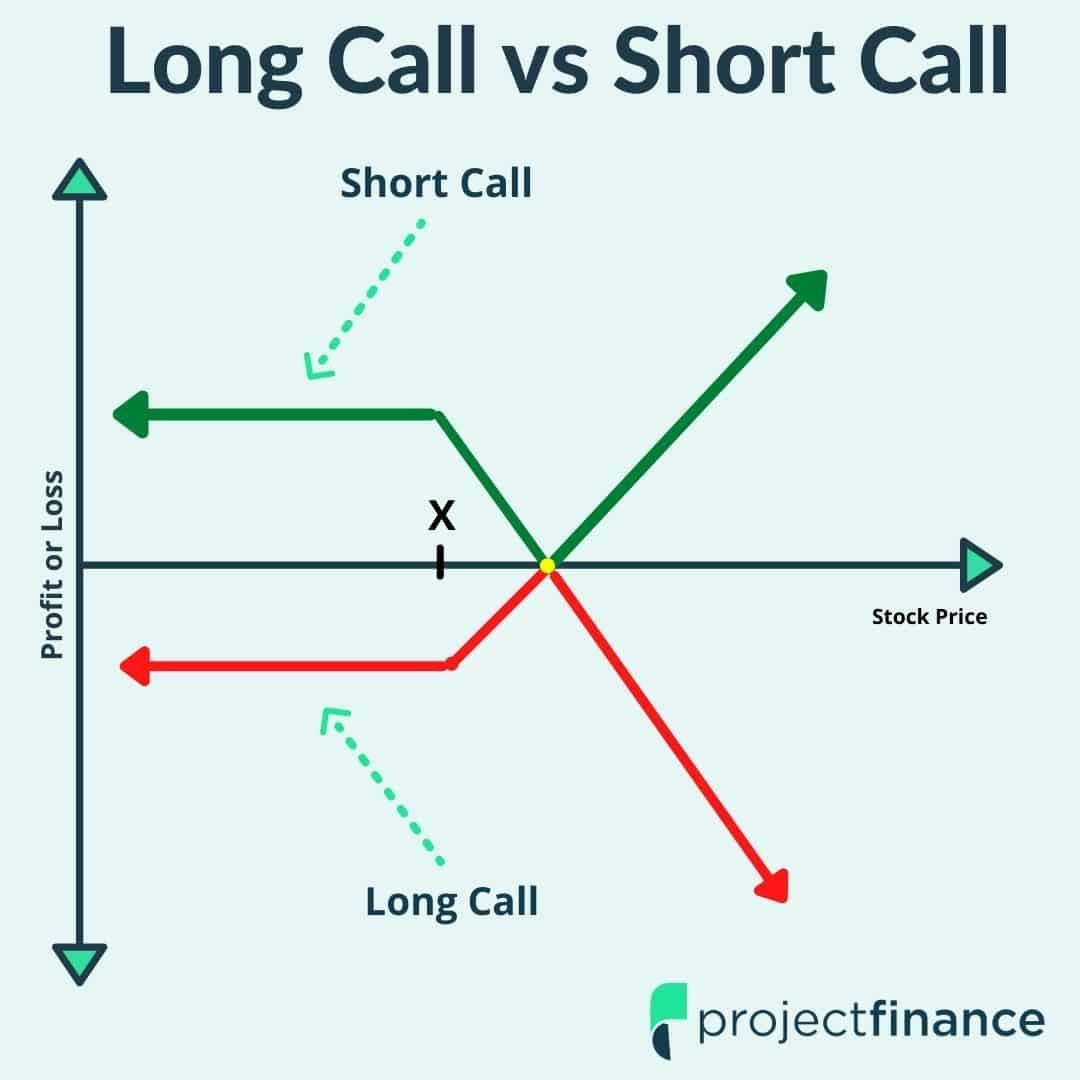

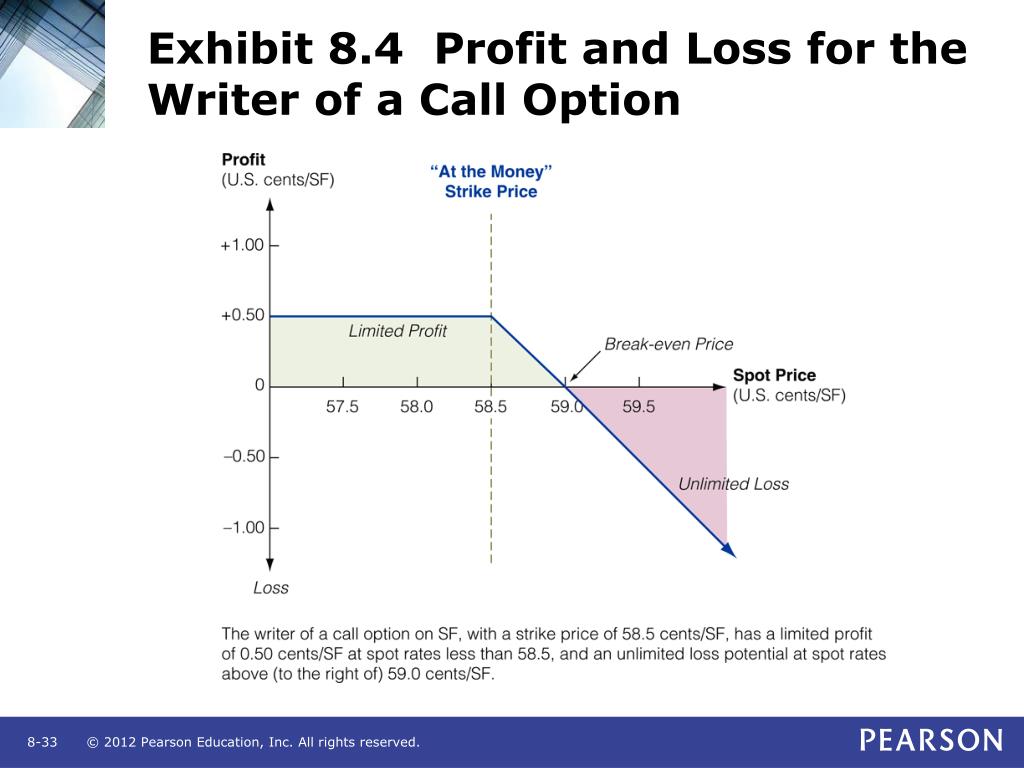

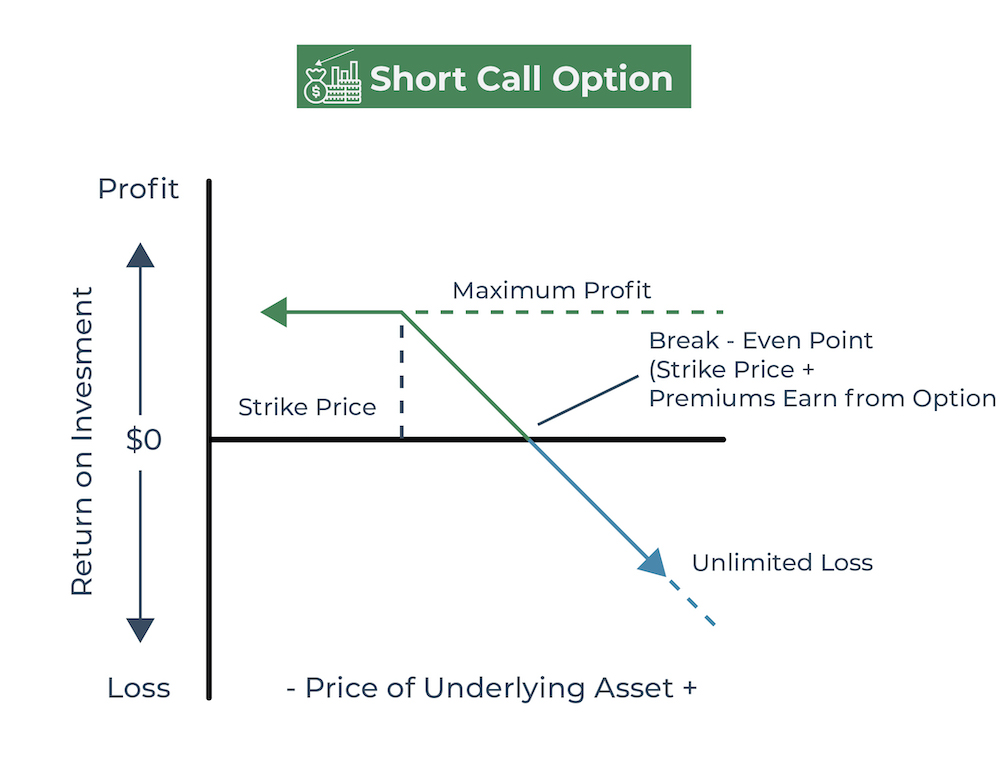

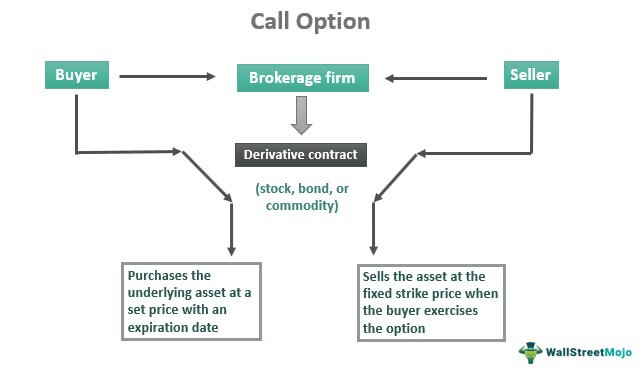

How to Close Options - Understanding Buy To Close / Sell to CloseA call option is a contract that gives the option buyer the right to buy an underlying asset at a specified price within a specific time period. Traders write an option by creating a new option contract that sells someone the right to buy or sell a stock at a specific price (strike price) on a specific. Writing call options is a process of giving a holder the right but not the obligation to buy the shares at a predetermined price.

Share:

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)