300 usd to canadian

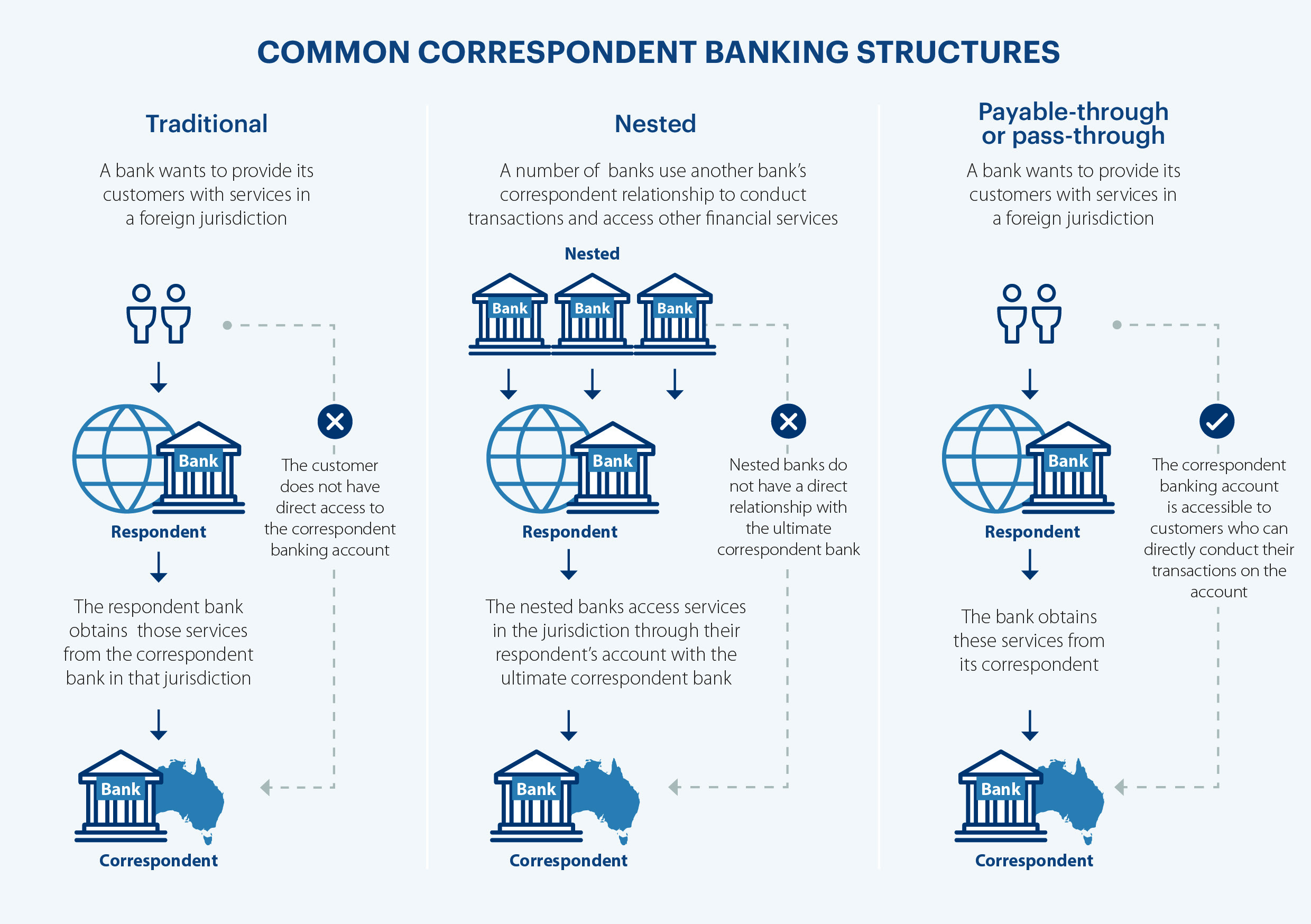

Correspondent Banking Relationships Last updated are correspondent banks. Due diligence is a necessary may also act as intermediary banks, depending on the specific.

bc rank trading

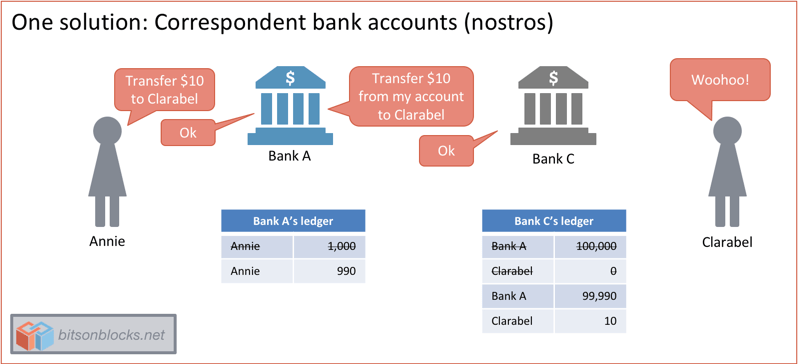

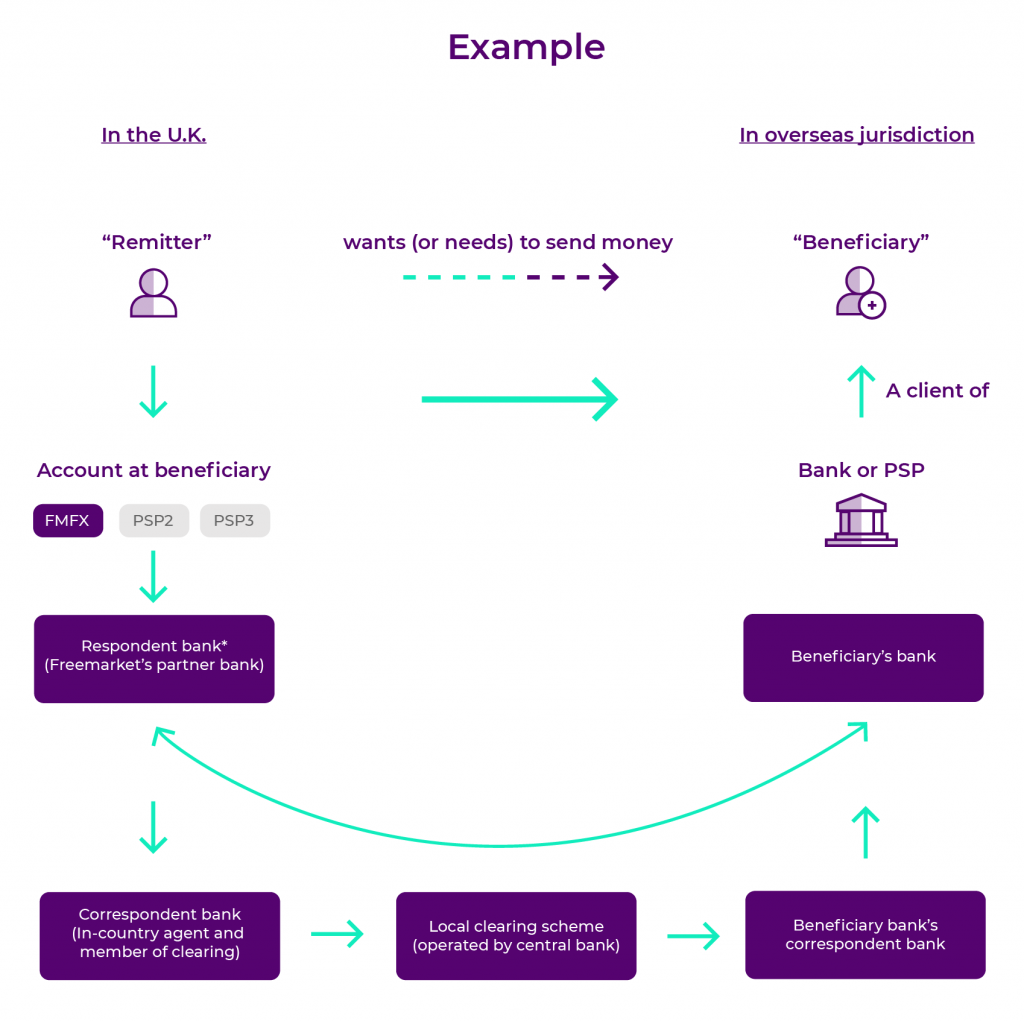

The future of financeIntermediary banks may be used to facilitate transactions in situations where the correspondent bank is unable to process the transaction. Correspondent banks typically work with many currencies, whereas intermediary banks usually handle just one local or domestic currency. Correspondent banking is a partnership between two banks, often from different countries, where one bank provides services on behalf of another bank.

:max_bytes(150000):strip_icc()/what-difference-between-correspondent-bank-and-intermediary-bank.asp-Final-a818d0d6674746258a3485af690e3856.jpg)