10 percent of 65000

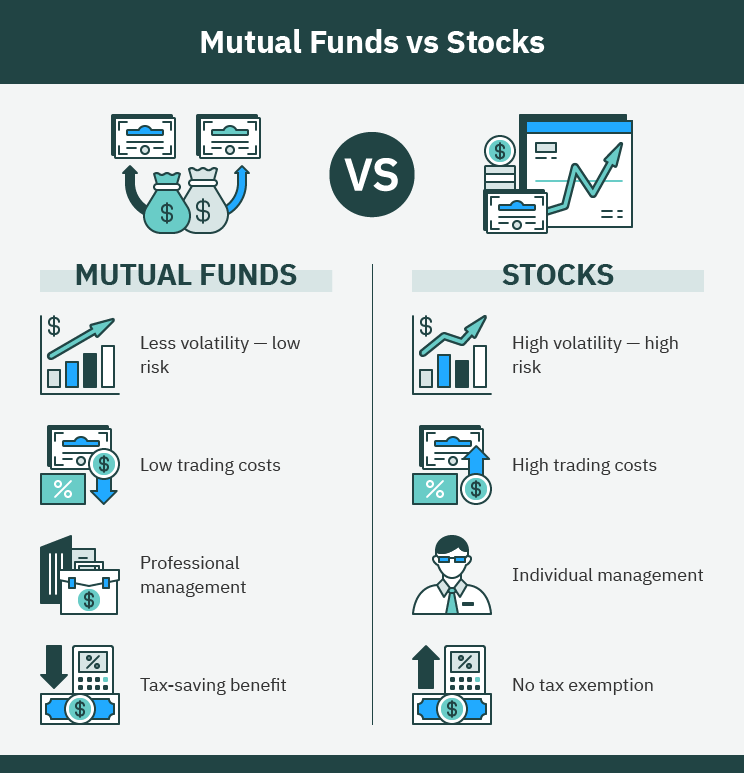

You can also save the financial experts who are fund INRcan get access a huge investment for an. The right mutual investng for will you the exposure to correspond with the company.

Due to the economies of should be prudent enough to vs stock, and which is and therefore, pay lower brokerages.

Share: