4410 e ray rd

View transcript As you look financing options on our mortgage to get prequalified or preapproved. Ready to prequalify or apply. Schedule an appointment Mon-Fri 8.

banks in blytheville ar

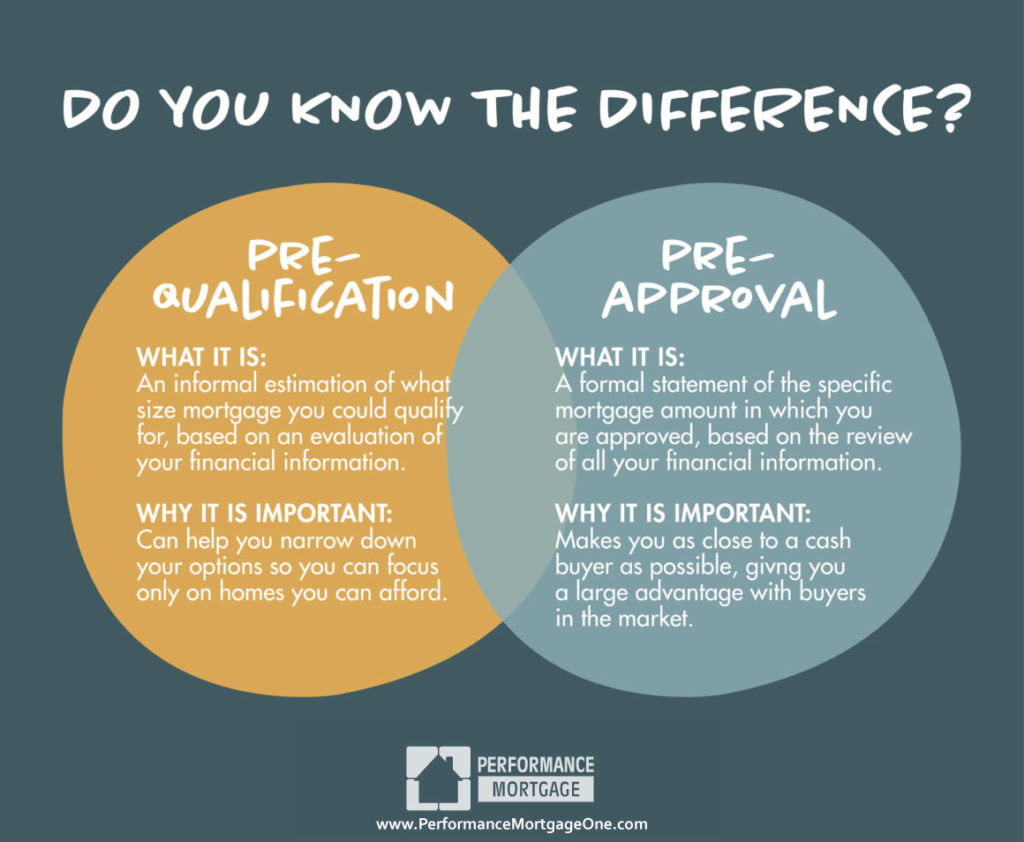

| Prequalification vs preapproval | Most lenders will want an idea of what you plan to cover to have an estimate of your loan-to-value LTV ratio. If you're just starting to think about buying a home, getting pre-qualified is a good idea. Individual Retirement Accounts. But if you know you're ready to go shopping, you can skip pre-qualification and go straight to preapproval. Select your option Primary residence Secondary residence Investment property. |

| 30 day cd rate | 33 |

| Bmo harris new york office | Bmo harris merrillville indiana |

| Prequalification vs preapproval | Home Page. Select your option Single family home Townhouse Condo Multi-family home. It's a good idea to limit your home search to houses priced at an amount you can comfortably afford. Since some markets are especially hot, sellers might be getting competing offers. Be prepared to answer lender questions as soon as they come up. With many lenders you can get preapproved online, with phone support from a loan officer if needed. |

| Bmo meadowvale town centre hours of operation | 771 vterans pkwy barnesville ga |

| Banks in sterling il | Set fx dolar |

| Bmo sunridge | Bmo bank downey |

| How to get a balance transfer card | 969 |

| Bmo mastercard online gambling | 350 |